Every home service business has its ups and downs. When work slows, covering expenses like payroll, supplies, and bills can get stressful. But slow seasons don’t have to mean financial strain. With the right strategies, you can keep your business running smoothly and set yourself up for success when things pick back up. Let’s dive into five of them.

5 ways to keep your business thriving in the off-season

1. Plan for the slow season before it hits.

The best way to handle a slow season is to prepare for it ahead of time. Look at past years to identify when business typically slows down. If you know which months are slower, you can plan ahead by taking out a line of credit, reducing unnecessary expenses, and lining up work in advance with recurring service agreements.

2. Keep marketing even when business is slow.

It’s tempting to cut back on marketing when things slow down, but that’s the time to stay visible. Stay active on social media, send emails to leads and existing customers, and invest in local advertising. A well-timed post or email can remind customers of services they need but haven’t scheduled yet. The more top of mind you are, the more likely they’ll book with you.

3. Reach out to past customers.

Your best customers are the ones who have already hired you. During slow months, send follow-ups to past clients, offer service reminders, and check in to see if they need any work done. A simple email or phone call can lead to unexpected business. Customers will appreciate the proactive approach, especially if you offer a small incentive like a discount to book now instead of waiting.

4. Focus on training and maintenance.

Fewer jobs on the schedule means more time to focus on what keeps your business running. Use any downtime to train your team, update certifications, or catch up on equipment maintenance. Investing in skills and upkeep during slow months helps keep your business in top shape when demand picks back up. It’s also the perfect time to streamline processes, boost efficiency, and set the stage for future growth.

5. Use financing to cover gaps.

Even with careful planning, cash flow can get tight during slower months. Having access to financing, like a business line of credit or short-term loan, can help you cover payroll and expenses without stress. Instead of scrambling, you can use these funds when you need them and pay them back when work picks up.

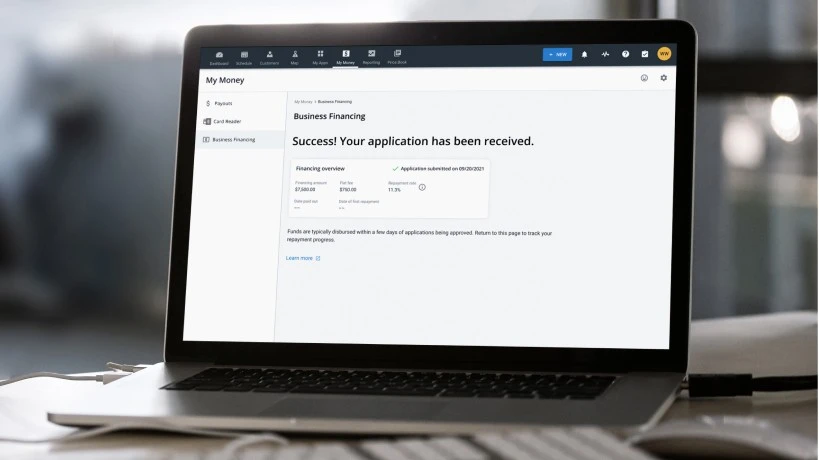

At Housecall Pro, business financing is built directly into our platform to simplify the process for you. You don’t need to spend hours finding the right documents, filling out endless paperwork, or waiting for a credit check. With a few clicks, you can apply for a line of credit. It’s that simple.

Pro tip: To qualify for business financing through Housecall Pro, you have to be an existing user of Payments through HCP Money. Don’t worry, it’s free to sign up! Already one of our Pros? Log in to your account now!

Keep moving even when business slows down

Slow periods are inevitable for any business, but with the right approach, you can keep the work flowing and come out stronger on the other side. Plan ahead, stay visible with marketing and customer outreach, focus on training, and use smart financing when needed to keep your business moving no matter the season.