Want to win more jobs with less effort?

Grow your business and send quick quotes with our home service software.

Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

Running a service business is about more than just covering the cost of labor and materials and taking care of your customers—you also have to account for overhead. Many business owners set their prices too low, only to realize later that they’re barely breaking even. Overhead costs, like rent, insurance, and equipment, can quietly eat into profits if not factored in correctly. This guide from Housecall Pro will share what overhead includes, how to calculate it, and ways to keep it under control so your business stays financially strong.

Understanding Overhead Costs

- What Are Overhead Costs in a Service Business?

- Types of Overhead Expenses in a Service Business

- How Does Overhead Affect Profit Margin?

- How to Calculate Overhead Costs for Your Business

- How to Allocate Overhead Costs in a Service Business

- How to Reduce Overhead Costs & Improve Profitability

- Keeping Overhead Costs Under Control

What Are Overhead Costs in a Service Business?

You’re probably somewhat familiar with the concept of overhead costs. However, it can be confusing as to what is considered overhead and what isn’t.

Overhead costs refer to the ongoing expenses required to operate a business that aren’t directly tied to a specific job or service. These costs remain consistent regardless of how many customers you serve or projects you complete. Unlike labor or materials that fluctuate with each job, overhead expenses are necessary to keep your business running day-to-day.

Here are some common overhead expenses for service businesses:

- Rent or Mortgage: The cost of office space, storage, or workshop areas.

- Utilities: Electricity, water, internet, and other monthly bills needed to keep operations running.

- Business Insurance: Coverage for liability, property, workers’ compensation, and other protections.

- Taxes and Licenses: Business taxes, permits, and industry-specific licensing fees.

- Company Vehicles: Maintenance, fuel, and leasing costs for work vehicles.

- Office Supplies: Items like computers, printers, software subscriptions, and everyday supplies.

- Depreciation: The gradual loss of value in equipment, tools, and property.

- Administrative Employee Salaries: Wages for office staff who handle scheduling, customer service, and bookkeeping.

- Marketing and Advertising: Website hosting, online booking tools, paid ads, flyers, and promotional efforts.

Types of Overhead Expenses in a Service Business

Now that you understand what overhead expenses are, let’s talk about how they are classified. Overhead costs generally fall into three categories: fixed, variable, and indirect. Understanding these classifications helps business owners predict expenses and manage their budgets more effectively.

Fixed Overhead Costs

These are expenses that stay the same regardless of how much work your business takes on. They are predictable and make up the backbone of your operating costs.

- Rent: The monthly payment for office space, storage, or a workshop.

- Insurance: Coverage for liability, property, workers’ compensation, or other business policies.

- Utilities: Recurring costs like electricity, water, and internet that keep operations running.

Variable Overhead Costs

These costs fluctuate based on the amount of work your business does. They tend to increase when business is busy and decrease during slower periods.

- Equipment maintenance: Repairs, servicing, and part replacements for tools and machinery.

- Travel expenses: Gas, lodging, and per diem costs for jobs that require travel.

Indirect Overhead Costs

These expenses support business operations but don’t directly tie to a specific job or service. They are necessary for running a business smoothly but don’t vary based on customer demand.

- Administrative salaries: Wages for office staff handling scheduling, billing, and customer service.

- Office supplies: Items like computers, printers, software, and general supplies needed for daily operations.

How Does Overhead Affect Profit Margin?

Profit margin is the percentage of revenue a business keeps after covering all expenses, including labor, materials, and overhead. It’s a key measure of financial health, showing how much of each dollar earned turns into profit.

Overhead directly affects profit margin because the higher these expenses are, the less money remains after covering costs—especially if pricing isn’t adjusted accordingly. If a business sets prices based solely on labor and materials without factoring in overhead, profits shrink fast.

To maintain healthy margins, service businesses must calculate the right markup. This means accounting for overhead in pricing so that each job contributes not just to covering direct costs but also to keeping the business running profitably.

How to Calculate Overhead Costs for Your Business

Many service businesses make the mistake of underpricing their jobs because they don’t factor in overhead. If you’re only considering labor and materials, you could be losing money without realizing it. Here’s how to break it down properly.

Overhead Cost Per Hour Formula

To determine how much overhead adds to each hour of work, use this formula:

(Total Monthly Expenses ÷ Total Working Hours per Month) × Hours to Complete the Job

Example Calculation:

- Total Monthly Overhead: $10,000

- Total Billable Hours per Month: 160

- Overhead Cost Per Hour: $10,000 ÷ 160 = $62.50

- Job Takes 5 Hours to Complete: $62.50 × 5 = $312.50

This means you need to charge at least $62.50 per hour just to cover overhead—before factoring in labor, materials, and profit.

Overhead Cost Per Job Formula

Another way to calculate overhead is by spreading costs across the total number of jobs completed in a year:

Overhead Cost Per Job = Total Annual Overhead ÷ Total Jobs Completed Per Year

Example Calculation:

- Total Annual Overhead: $50,000

- Total Jobs Completed Per Year: 500

- Overhead Cost Per Job: $50,000 ÷ 500 = $100

Each job must account for at least $100 in overhead costs to break even.

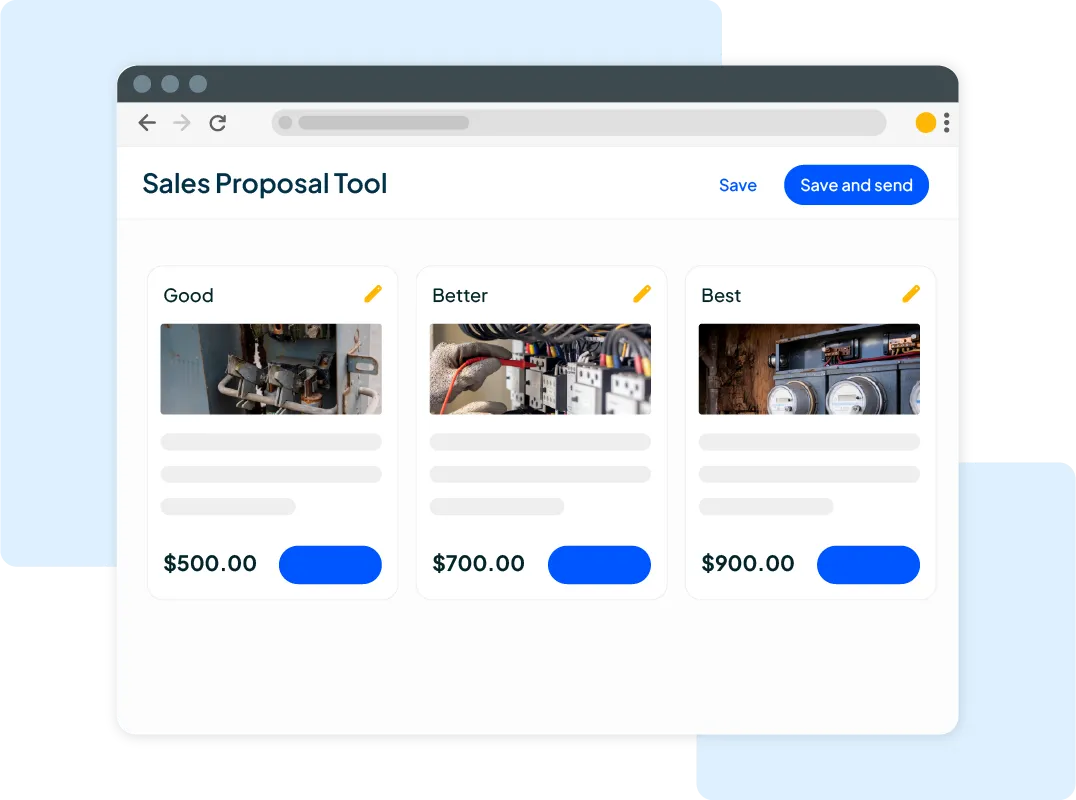

Try Our Free Service Price Calculator

We know you don’t want to keep guessing. That’s where we can help. Housecall Pro’s service price calculator takes the guesswork out of pricing by automating these calculations.

How It Works:

- Enter your total monthly expenses, billable hours, and annual job volume.

- The calculator determines your overhead costs per hour and per job.

- Adjust your pricing to reflect overhead, labor, materials, and profit.

How to Allocate Overhead Costs in a Service Business

For a typical service business, overhead costs generally make up around 35% or less of total revenue, though this can vary depending on the industry and business model. Keeping track of how these costs are allocated will help you with accurate job pricing and profit margins. There are several ways to distribute overhead costs effectively.

Percentage of Revenue Method

This approach assigns overhead as a fixed percentage of total revenue. For example, let’s say your overhead costs amount to 30% of revenue; your pricing should reflect that percentage to cover expenses while maintaining profitability.

Direct Labor Cost Method

Overhead can also be allocated based on direct labor costs. This means dividing overhead across the total number of labor hours worked. The more labor-intensive a job, the higher its share of overhead costs.

Per-Job Allocation

For businesses with consistent job volume, overhead can be distributed evenly across all completed jobs. For an example, please refer to what we shared above when discussing overhead costs per job.

How to Reduce Overhead Costs & Improve Profitability

Managing overhead isn’t just about keeping expenses in check—it’s about protecting your business from financial strain. In fact, 82% of businesses that fail cite cash flow problems as the reason. When overhead costs are too high, even steady revenue may not be enough to keep the business running smoothly.

The good news? Small adjustments can lead to big savings. By identifying areas where overhead can be trimmed, service businesses can free up cash flow, strengthen margins, and build long-term stability.

Here are some practical ways to reduce overhead without sacrificing quality.

1. Cut Recurring Bills

Review your monthly expenses and eliminate anything that isn’t necessary. Negotiate better rates on rent and insurance or explore alternative providers. Switching to cost-effective business software can also help reduce costs while keeping operations efficient. And remember, this is not a one-and-done type of exercise. To keep your overhead expenses in check, do a regular audit to make sure you’re not paying for services you no longer need.

2. Automate Systems

Time is money, and handling tasks manually can be a major drain on both. If you’re still scheduling jobs, sending invoices, or tracking payments by hand, you’re spending valuable hours on admin work instead of growing your business.

Pro Tip: Use Housecall Pro to automate scheduling, invoicing, and payment collection—cutting down on administrative costs and freeing up time for higher-value tasks. And we all know how valuable getting some extra time back can be.

3. Lease Equipment Instead of Buying

Purchasing trucks, tools, or heavy machinery requires a significant upfront investment that can strain cash flow. And, when you buy these items outright, you are responsible for repairs, following through on warranties, etc.

Leasing allows businesses to spread costs over time, keeping more cash on hand for day-to-day operations. Plus, leasing often includes maintenance, reducing repair expenses. If the equipment isn’t needed long-term, renting instead of buying may be the smarter choice.

4. Hire Contractors or Part-Time Staff

Full-time employees come with additional costs beyond their salaries. According to the U.S. Bureau of Labor Statistics, benefits comprise about 30% of the average worker’s paycheck—including health insurance, paid time off, and retirement contributions. Hiring contractors or part-time staff can help control labor costs in a big way, especially if you don’t need them year-round or a full 40 hours per week.

5. Scale Back Marketing Spend

Most businesses allocate 5% to 10% of sales toward marketing, but not all strategies deliver a solid return. Traditional ads—like billboards, flyers, and radio spots—can drain resources without measurable results. Instead, focus on search engine optimization (SEO), creating an impressive Google Business Profile with reviews from real customers, and local social media marketing to attract leads organically. Referral programs can also drive new business without the high costs of print ads or pay-per-click (PPC) campaigns.

6. Buy Bulk & Negotiate Vendor Pricing

Many service businesses overspend on materials because they buy in small quantities. Bulk purchasing often comes with discounts, reducing per-unit costs. Build relationships with suppliers and negotiate better rates—loyalty can lead to price breaks. Consider joining group purchasing programs to access wholesale pricing and maximize savings on essential supplies.

7. Outsource Administrative & Accounting Tasks

Hiring an in-house bookkeeper or administrative assistant adds salary and benefits costs. Instead, use a virtual assistant for administrative tasks and software like QuickBooks to handle accounting. Outsourcing keeps overhead low while prioritizing these critical tasks are still managed professionally and accurately.

8. Downsize Office Space

Rent is one of the biggest overhead expenses, yet many service businesses don’t actually need a large office. If most work happens on-site or remotely, consider a smaller office, co-working space, or fully remote setup. While it can feel like a burden to pick up and move operations, reducing office space can significantly cut monthly costs without impacting operations.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

Keeping Overhead Costs Under Control

Overhead costs aren’t static—they fluctuate as businesses grow, prices change, and new expenses arise. That’s why regularly reviewing expenses is so important for maintaining healthy margins. Small savings across multiple areas can add up, freeing up cash flow and increasing profitability over time. And this is a winning combination.

Tracking overhead costs can help service businesses:

- Identify wasteful spending: Spot unnecessary expenses and cut back where possible.

- Make informed pricing decisions: Adjust service rates to reflect true operating costs.

- Improve cash flow management: Avoid financial strain by planning for fixed and variable costs.

- Enhance scalability: Keep costs lean so your business can grow without overspending.

- Increase overall profitability: Retain more revenue by controlling recurring expenses.

Keeping overhead under control doesn’t mean sacrificing quality or efficiency—it’s about spending strategically. Digital tools from Housecall Pro help service businesses automate administrative tasks, manage jobs efficiently, and track expenses all in one place. By leveraging technology, businesses can keep costs low while staying organized and profitable.

Start simplifying your operations today with Housecall Pro.