Get out of a plateau and into a growth phase.

As your home service business grows, so does your need for available cash. Increased revenue often comes with higher costs, like payroll, equipment, materials, and day-to-day expenses that grow with demand. But—like any Pro knows—income in the home services industry can be unpredictable. Sometimes you get paid right after a job, and other times you’re waiting on invoices. Not to mention the seasonal ebbs and flows of business.

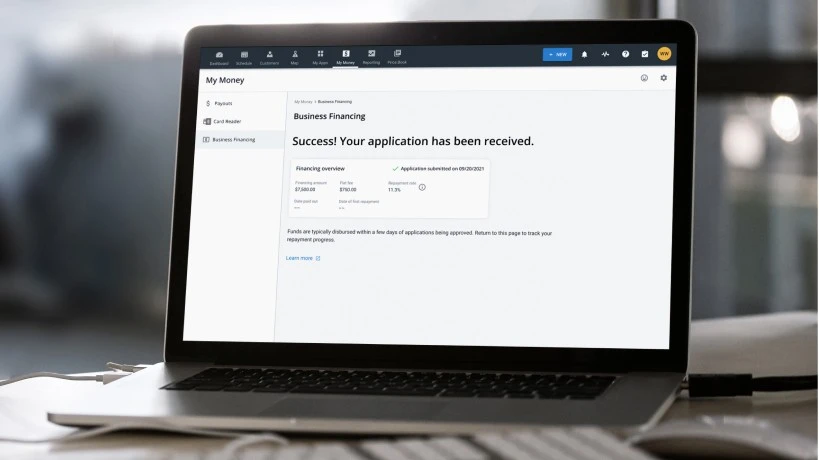

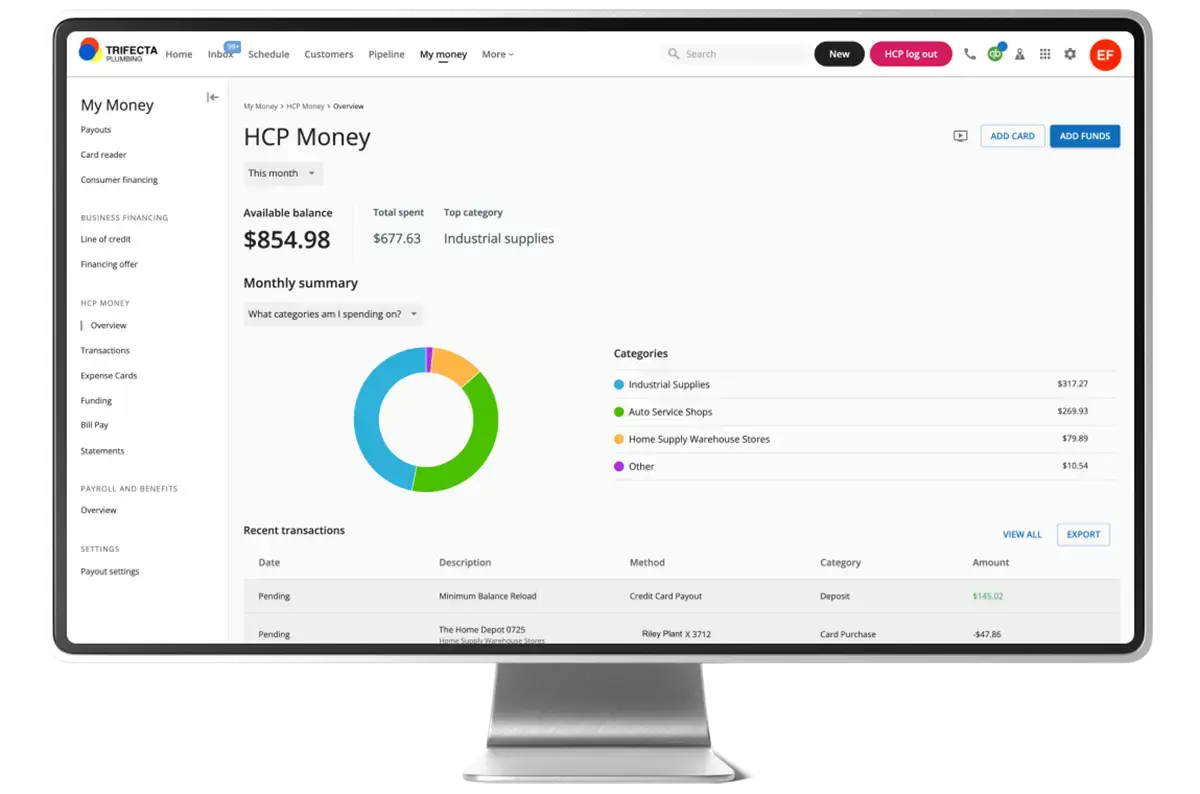

At Housecall Pro, we understand Pros might not always have access to a steady cash flow. You might be stuck in a cycle of having just enough cash to make a profit, but not enough to grow your business to its full potential. That’s why we’ve made it easier than ever for you to access business financing. Best of all, you can find it in the same place you already manage your business operations—the Housecall Pro app!

So, how do you stop the cycle of “just getting by” with a business advance? Let’s break it down.

5 Ways a Line of Credit Can Help Home Service Pros Thrive

1. Cover Costs in Slow Months

Most home service businesses have busy and slow seasons. An HVAC company might see a surge of work in summer but slow down as temperatures cool. Similarly, landscapers may stay busy in spring and summer but have fewer jobs in fall and winter.

Without financing, you might have to stretch out payments or cut costs during these slower times just to stay afloat. A line of credit gives you access to funds when you need them most, allowing you to cover payroll, vehicle costs, or other fixed expenses without worry. This means you can keep your team paid and maintain consistent operations all year long, making it easier to grow when busy seasons return.

2. Take on Bigger Jobs

High-value jobs can be game changers, but they often require more up-front costs. For instance, if you’re a plumber who lands a major commercial repiping project, you might need to pay for materials like copper pipes, fittings, and specialized equipment before work can begin. You may even need to hire additional crew members or subcontractors to manage the extra workload. Without financing, you might pass on these opportunities, which can keep your business from growing in so many ways.

With a line of credit, you can confidently pursue and take on larger jobs, knowing you’ll have the cash flow to support them. By being able to say “yes” to these projects, you can boost your revenue significantly and set your business up for better cash flow and growth.

3. Handle Unexpected Expenses

With equipment and team members out in the field on a daily basis, surprises can pop up when you least expect them—from truck breakdowns to last-minute material needs. Every business deals with unexpected costs at some point, but they don’t need to derail you.

Having a line of credit allows you to handle these expenses immediately, without scrambling for funds or needing to dip into potential cash reserves. This keeps your business running smoothly without interrupting work or cutting into your revenue. You can pay for repairs or replacements up front, making it easier to maintain a steady pace and avoid downtime while providing a great customer experience.

4. Invest in Tools to Grow Your Business

Growing your business often means investing in equipment, technology, or even marketing to increase your leads as well as efficiency. With business financing, you have the flexibility to make these upgrades when they’re needed, not just when you can afford them.

For example, a lawn care company might find a bulk deal on fertilizer or specialized tools that could save them money over time, but they need the cash up front to take advantage of it. A line of credit lets you make investments without putting strain on your cash flow. Over time, the right tools and upgrades help you work faster, serve more customers, and boost your bottom line.

5. Focus on Marketing and Other Growth Opportunities

Marketing is essential to maintain a healthy stream of jobs, but it can be tempting to cut back on it during slower months when money may be trickling in. A line of credit gives you the flexibility to focus on marketing year-round, which can be key to keeping your schedule full and cash flow positive.

For instance, a window cleaning business might run seasonal promotions in the fall to attract more clients, or an HVAC Pro could invest in ads reminding customers to schedule heating checks before winter. With financing, you can fund these campaigns without waiting for cash to come in from jobs. This lets you reach new customers, fill up your schedule, and build momentum so that even in traditionally slow times, you’re bringing in enough work to keep cash flow steady.

Business Financing Is More Than a Quick Fix to Stay Afloat

Running a home service business comes with its share of challenges, and cash flow shouldn’t be one of them. Whether it’s covering everyday expenses, handling unexpected costs, or taking advantage of new opportunities, having access to financing offers you the flexibility and control you need to manage the ups and downs of your business and drive growth.

At Housecall Pro, business financing is built directly into our platform to simplify the process for you. You don’t need to spend hours finding the right documents or filling out endless paperwork. With a few clicks, you can apply for and access a line of credit. It’s that simple.

Already one of our Pros? Log in to your account now!

Pro tip: To qualify for business financing through Housecall Pro, you have to be an existing user of Payments through HCP Money. Don’t worry, it’s free to sign up!