We use credit card readers hundreds, if not thousands of times every year. When we get coffee. Pump gas. Purchase groceries. We do it so often that we rarely, if ever think about how credit card readers work.

If you think about it, credit card readers are pretty amazing. You insert your plastic card, and within a few moments, the reader contacts your bank, checks if you have the proper balance, withdraws the money, and credits it to the seller.

But what is going on behind the scenes? And when it comes to your small business, what are the best credit card readers?

That’s what this article is all about. We’re going to break down the what, why, and how of credit card readers. We’re also going to help you make the best choice in terms of which one you should use in your small business.

Let’s dive in.

How Do Credit Card Readers Work?

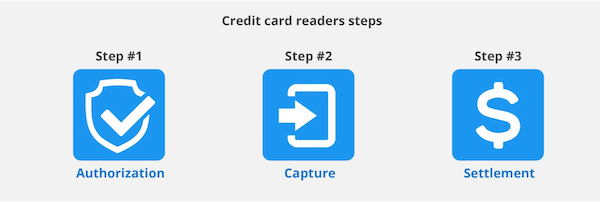

Generally speaking, three basic steps occur when you use your credit card to make a purchase.

Step #1: Authorization

The first step is to authorize the transaction. When you tap or swipe your credit card, the payment request is sent to the credit card company. They then pass the transaction to a financial institution known as the acquiring bank (also known as the merchant bank or acquirer).

The acquiring bank acts as the middle man in the transaction. They send the authorization request to the issuing bank (your credit card company). The issuing bank then checks to ensure that the customer has enough funds for the charge. The issuing bank also uses fraud detection methods to ensure that the transaction is not fraudulent. If everything is in order, the transaction is authorized, and a hold is put on the funds so that they can’t be used for anything else.

Step #2: Capture

Once the transaction has been authorized, the funds are moved from the credit card company to the acquiring bank. Typically, many payments are moved in one big batch, which is why this process is often called “batching.”

Step #3: Settlement

After the transaction has been authorized and captured, the funds from the credit card sale are settled through your credit card company’s systems and deposited in your account.

Credit Card Payment Technology

Not that long ago payment with a credit card involved a simple swipe – nothing more, nothing less. When swiped, the reader took the info stored in the black, magnetic stripe or magstripe, and sent it to the bank, which kicked the transaction into high gear.

New advances in technology and a greater concern for security has turned the swipe into a novelty.

Today, there are faster, more secure ways for you to collect payments from your customers, one of which doesn’t involve a physical card at all.

Chip Payments

What is quickly becoming the go-to form of credit card payment, chip-enabled credit cards are those with small squares on the front of the card.

Also called EMV (Europay, MasterCard, Visa), this square or chip allows a user to make a contact payment – inserting the card into a reader – or contactless payment – holding the card near a terminal or by simply tapping the reader.

Credit cards with the chip technology may support one or both payment actions.

The most significant benefit of the chip, however, is the increased security. Due to its level of encryption, EMV promotes a more secure transfer of information during the transaction.

Contactless, Apple Pay, Google Pay

The other major form of card payment seeing an increase in popularity is contactless payments.

As we mentioned, certain credit cards already support this by way of the chip insert using near field communication (NFC) or radio-frequency identification (RFID).

However, most now associate contactless payments with the use of a smartphone. With this technology, a consumer’s credit card data is stored within their handheld device or wearable tech – an Apple iPhone or Watch for instance.

With their Apple Pay or Google Pay app active, the customer just has to hold their device near a credit card reader to initiate the payment.

Types of Card Readers

So that’s how a card reader works. What about the types of card available for your small business to use?

The most popular readers come in three types: Countertop, Mobile, and Portable.

Countertop Credit Card Readers

Without question, counter set readers are the most popular and widely used card reader today. Even with wireless technology making payments more mobile (which we’ll get to in a minute), the countertop is used in practically every physical store or shop a credit card is accepted.

A countertop reader is a wired point of sale (POS) device and requires an electrical outlet and a physical phone or internet connection. These systems work best for businesses where mobility is not a vital requirement and transactions occur at a permanent spot.

Mobile Credit Card Readers

If mobility is essential for your business than a mobile card will address those needs. Mobile readers are designed to accept payment via software.

Depending on the specific systems used, the mobile software can process payments via a connected (to a smartphone or tablet, for example) swipe device or chip reader or through contactless methods such Apple or Google Pay.

As the name states, mobile readers are perfect if your business is on the move and requires accepting payments wherever your work might take you.

Portable Credit Card Readers

Finally, the third type of card reader is the portable version. This system is mobile up to a point. It includes a plugged-in base unit and a secondary handheld device that operates and accepts payments within a set range from the base.

Operating through Bluetooth connectivity, this type of card reader works well if you want to accept credit cards within a business space without being tied to a counter or desk.

Finding the Right Credit Card Reader for Your Business

When it comes to credit card readers, the vast majority are all comparable with each other. Only a few minor pros and cons separate the various options, with price and software the biggest differences.

The key is to find the right overall system that is both reliable and best suits your business. These are the key factors to consider when figuring out the right card reader for you.

1. Is the system mobile?

Perhaps the most crucial factor for a home service business is whether or not you can accept payments on the go.

Turning your points of service into points of sale creates a huge advantage for your business. Not only do you get paid faster, but it provides your customers with a more convenient way to pay. Ultimately, it streamlines the entire process for everyone.

Even if you operate a business where mobile payment acceptance isn’t a necessity, it may be beneficial to have that option for future growth opportunities.

2. Does the system offer online payments?

Even if your company isn’t mobile or accepts very few mobile payments, you’ll still want to offer your customers a highly convenient method to pay “on-the-go.” Which is why you should look for payment software that allows ecommerce payments.

In our current digital climate, internet-based payment options are quickly becoming a requirement if your business hopes to stay competitive.

3. Can the system support recurring billing?

Is repeat business at the core of the services you provide? Do you want to make it both easier to bill and receive payment on a regular, repetitive schedule?

If you answered yes to both questions, then your credit card payment software needs to possess recurring billing capabilities. Even if you answered no, this should be a priority for your business to generate regular, recurring income.

Having capable software when you do make it a priority will ensure a far smoother transition.

4. Is the price right for my business?

Pricing in the credit card reader business can get tricky, but it basically comes down to two variables: the fixed costs and the variable costs.

Whether you generate $1,000, $10,000, or $100,000 in monthly sales you’ll want the service (and accompanying fee structure) that matches best with your business.

Many of the top providers have upfront, one-time costs for the equipment and software you need to start processing credit card payments. Some providers also have a monthly charge for using their service.

The primary difference comes with the per-transaction fees. This will vary based on the processor and the types of payments accepted (for instance, swiping or inserting a card will cost less than if the credit card info is keyed in manually).

As a general rule, if the fixed costs are low, then the variable rates are higher. For example:

Provider 1 charges a $25 monthly fee and 2.5% transaction fee.

Provider 2 charges no monthly fee and 2.75% transaction fee.

With Provider 1:

- $5,000 in monthly transactions * 2.5% + $25 = $150 in total monthly fees

- $25,000 in monthly transactions * 2.5% + $25 = $625 in total monthly fees

With Provider 2:

- $5,000 in monthly transactions * 2.75% + $0 = $137.50 in total monthly fees

- $25,000 in monthly transactions * 2.75% + $0 = $687.50 in total monthly fees

As you can see the higher monthly fee, lower transaction fee is better for the high volume business. The lower monthly fee, higher transaction fee is better for the low volume business.

It’s also worth noting that some providers will attach an additional, flat per transaction fee to their variable costs. So it’s essential to look at not just your total transactions in terms of dollars but also the number that makes up that total as well.

What Are The Best Credit Card Readers?

Now that you know the basics of how a credit card reader works and what to look for, let’s talk about the best credit card readers.

1. My Money by Housecall Pro: Best for Home Services

If you want a solution designed specifically with your home service business in mind, few options will serve you better than My Money by Housecall Pro. Their card readers, including Bluetooth connectivity, are similar to those of Square with rates that run slightly cheaper. Payments can be processed via the Housecall Pro app, which is well-designed and very intuitive, your own built-in processor, or through the My Money Card Reader. Users can also automatically reconcile their transactions through Quickbooks and turn around in field payments faster with their Instapay system, both of which are big time-saving advantages for small businesses.

My Money by Housecall Pro Pricing:

Magstripe, Chip and Contactless Reader: $59.00

Processing Fees (swipe, chip, contactless): 2.59%

Processing Fees (online): 2.99%

Monthly Housecall Pro Fees: Basic plan at $49 per month, Essentials plan at $109 per month, MAX plan (enterprise solution) rates vary

2. Dharma: Best for High-Dollar Transactions

Dharma is built for firms that consistently process big numbers – think greater than $10,000 on average per month. If you’re not a high-volume company, then you probably won’t meet their threshold. If you do, you’ll find a very transparent provider with dependable customer service and plenty of rave reviews about their flexibility in payment methods accepted (all credit cards, including magstripe, chip, Apple and Google Pay) and feature-rich software.

Dharma Pricing:

Magstripe, Chip and Contactless Reader: $99.00

Processing Fees (in-person major credit cards): 0.15% + 7 cents per transaction

Processing Fees (online): 0.20% + 10 cents per transaction

Processing Fees (AmEx): 0.25% + 10 cents per transaction

Monthly Fee: $20

Closure Fee: $25

3. Fattmerchant: Best for Seasonal Businesses

The reason Fattmerchant wins out for highly specific seasonality business is that for a small fee it offers the option to pause your account when not in use. The company does charge a $99 monthly fee to firms with annual transactions less than $500,000 and $199 per month for companies with annual transactions greater than $500,000. However, when active, the pause feature only costs you $25 per month, thus avoiding the higher fees. Aside from that helpful feature Fattmerchant closely mirrors Dharma in terms of pricing, reader equipment, and its fit for larger volume businesses.

Fattmerchant Pricing:

Magstripe and Chip Reader: approximately $75.00

Contactless Reader: undisclosed

Processing Fees (card present): Interchange + 8 cents per transaction

Processing Fees (card not present): Interchange + 15 cents per transaction

Monthly Fee: $99 less than $500,000 annual transactions; $199 more than $500,000 annual transactions

Pause Fee: $25

4. PayPal Here: Best for PayPal Users

PayPal is one of the most popular and simple online payment systems around. They apply that same ease of use to their card reader system with two options for card readers, straightforward fee structure, and a very robust app. They do have a monthly fee for accepting PayPal payments but otherwise is quite similar to Square. You could run into issues if you’re not entirely in tune with the PayPal ecosystem, but if you are, their reader option is a no brainer.

PayPal Pricing:

Magstripe and Chip Reader: $24.99

Magstripe, Chip and Contactless Reader: $74.99 (does include charging stand)

Processing Fees (swipe, chip, contactless): 2.7%

Processing Fees (online / in-store): 2.9% + 30 cents per transaction

Processing Fees (keyed in): 3.5% + 15 cents per transaction

Monthly Fee: $30 (no fee if you strictly accept credit card payments)

5. Shopify: Best for Ecommerce

If you manage or need to maintain an ecommerce store, it’s hard to find anything better than Shopify, one of the best, all-around ecommerce providers today. Their readers basically serve as an extension of your online store, and they provide you every tool necessary to seamlessly integrate both your on and offline operations. Fees are in line with both Square and PayPal, but Shopify does require you to have an ecommerce account, and the higher the plan, the lower the fees.

Shopify Pricing:

Magstripe and Chip Reader: Free ($29 for each additional reader)

Magstripe, Chip and Contactless Reader: $89.99

Processing Fees (swipe, chip, contactless): Basic – 2.7%; Shopify – 2.5%; Advanced – 2.4%

Processing Fees (online / in-store): Basic – 2.9% + 30 cents per transaction; Shopify – 2.6% – 30 cents per transaction; Advanced – 2.4% + 30 cents per transaction

Additional Fees (3rd party processor): Basic – 2%; Shopify – 1%; Advanced – 0.5%

Monthly Online Ecommerce Fee: Basic at $29 per month, Shopify at $79 per month, and Advanced at $299 per month

6. Chase Merchant Services: Best for Chase Bank Customers

We’ve covered that if you use PayPal or Shopify already, adding their respective card readers can prove beneficial for your company. The same is true if you use Chase for business banking. From receiving your money faster to the potential to negotiate rates, there is plenty to like if you are accustomed to doing business with Chase. A few drawbacks, however, include the murkiness with which they publicize their rates and the high upfront cost of their two card readers. Ultimately though, if you’re comfortable with Chase as your bank, them serving as your card reader solution could also be a good fit.

Chase Pricing:

Magstripe and Chip Reader: $95.00

Magstripe, Chip and Contactless Wireless Reader: $420.00

Processing Fees (in-person debit): 1.99% + 15 cents per transaction or 2.89% flat rate

Processing Fees (in-person credit card): 2.99% + 15 cents per transaction or 2.89% flat rate

Additional Fees and Prices: must contact Chase for an individual quote

7. Square: Best for Small Businesses

If you’re looking for a robust point of sale system that is simple and easy to use, it’s hard to beat Square. The best provider for small business, Square provides you a lot of flexibility with mobile, counter and online solutions and takes all forms of payment including Apple and Google Pay. They also offer plenty of extras that serve businesses of any size but give smaller ones a nice feature set without a huge cash commitment. These include 24/7 customer support, analytics, and tools for managing inventory.

Square Pricing:

Magstripe Reader: Free

Chip and Contactless Reader: $49.00

Processing Fees (swipe, chip, contactless): 2.75%

Processing Fees (online / in-store): 2.9% + 15 cents per transaction

Processing Fees (keyed in): 3.5% + 15 cents per transaction

Monthly Fee: None

Final Thoughts

A card reader is an incredible convenience for both you and your customers and makes a huge impact on your bottom line.

Just remember that although they may all seem similar, there are enough minor differences between providers in their fees, software, and physical tech that choosing the wrong one could cost you money.

Doing proper due diligence and taking into account not just what you make in total each month, but also the number of transactions involved in that total will ensure you choose the best solution for your business.