Want to win more jobs with less effort?

Grow your business and send quick quotes with our home service software.

Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

When running a business, there are a number of essentials to keep in mind. Having an accurate, reliable invoice number is among the most important. Though that number may not seem all that complicated, it can wind up playing havoc if you don’t have it set up properly.

Housecall Pro can make it easy to create the proper invoice number for your needs. Regardless of which method you choose, it will be simple to generate invoice numbers, easily document them, and perform a simple search when necessary. Let’s learn all that there is to know about invoice numbers and why they are so important.

What is an Invoice Number?

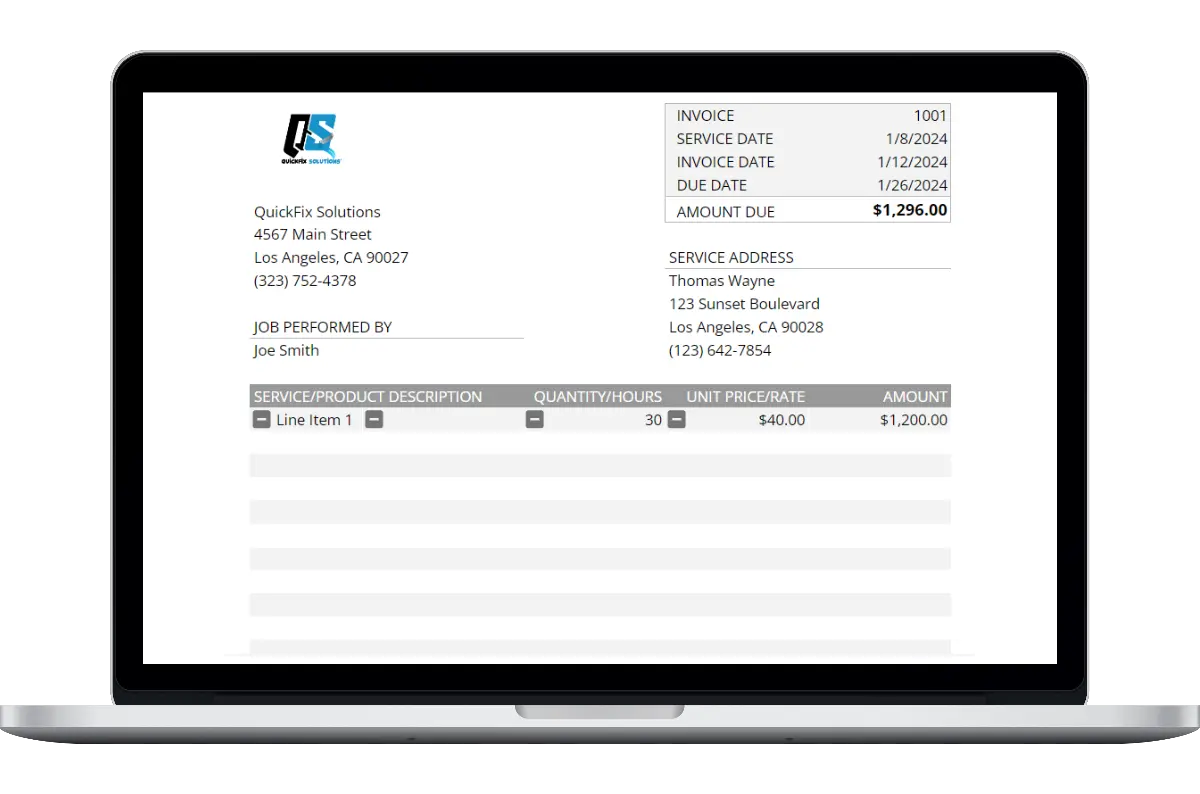

An invoice number assigns a designation to a particular invoice. Each invoice contains essential information like customer contact information, business contact information, goods and services performed, and an itemized breakdown of those costs.

The invoice number allows the business to reference that invoice at any time. Whether it be for correction or taxation purposes (or something else), the invoice number makes it simple to call up a particular invoice at any time.

Why are Invoice Numbers Important?

Invoice numbers are essential for a business. The biggest reason is that they allow said business to track information related to that invoice. Most importantly of all, payments that have been made can be tracked through invoice numbers.

From a client standpoint, invoices are great because they can reference their specific invoice number. It makes finding and reviewing invoices both quick and easy.

What to Include in an Invoice

Whether using a template, invoicing software, or creating an invoice on your own, it helps to know what to include in an invoice. Each invoice should have a few pieces of essential information, though the template can be customized to include anything deemed necessary.

Business and Customer Information

A simple but common mistake made when creating invoices is excluding either business or customer information. Without that information, a lot of things can go wrong. Include your business information – phone number, address, email, etc. – and the same for the customer. It ensures that the invoice goes to the right place while creating far fewer issues and delays.

Detailed Services List

The worst invoices are the ones that are vague. They may include customer information and pricing, but not information on the work performed. To limit questions from the customer, always include a detailed list of services. A brief description of that service should properly communicate what was done.

All Charges and Available Payment Methods

Be sure to include all relevant charges in an invoice. These should be posted next to each of the services as well as a cumulative total at the bottom. Be sure to separate taxes to show that charge, then the total due.

Additionally, make any payment methods known. Customers pay their bills when it is made easy for them. Knowing how they can make those payments simplifies the process and gives them the proper avenue for making a payment.

Payment Due Date

It is critical as a business to get paid for work done. On any invoice, it is imperative to include the payment due date. More often than not, missing information leads to businesses having to chase down payments. By including all of the necessary information, the onus is shifted to the customer without requiring them to jump through hoops.

How Should I Assign Invoice Numbers?

In order to create a proper invoice, a good invoice number example is needed. What you may not have realized is that there are several ways to assign invoice numbers for your business. There is no “right” way to do it, simply find the one that feels most logical and comfortable for your business.

Project or Client Codes

A common method for creating an invoice number is by using project or client codes. If you work with a variety of clients or projects, include a code for them in the invoice number. It’s a simple way to do things and makes it clear immediately which client you are servicing.

For example, if you are working with a company known as ABC, start out their specific invoices with the “ABC” denotation. Your first invoice would be “ABC-001,” the next “ABC-002,” and continue on down the line. Companies that deal with a wide array of clients may find this method easier to keep them sorted.

Including the Date

Another commonly used invoicing option involves using the date when creating an invoice number as well as a sequential number for any invoices sent on that particular day. Though it may sound initially confusing, the process is actually quite simple and a commonly used practice.

Let’s say that you are sending a pair of invoices on May 15, 2024. The first invoice may look something like this: 2024-05-15-001. The next invoice would be the same but end with a 002 sequential number. By using this method, it is easy to know when the invoice was sent and how many went out on that day. If you send a lot of invoices, it may not be the most effective method, however.

Use Sequential Numbers

Perhaps the most common method when it comes to creating an invoice number is to use sequential numbering. It is simple, straightforward, and doesn’t require much in the way of instruction. When in doubt, go with the sequential method.

It could not be easier to start. Begin with “1” or “001” (or whatever you want) and simply go in sequence. It is the easiest method to implement and makes organizing invoices simple. The only downside is that you won’t necessarily glean extra information out of the invoice number as you would with something like a client code or dated invoice, but sequential numbering is also quicker and easier to implement.

Combining Methods

While you may begin with one of the aforementioned methods, with time it may become obvious that your invoicing system requires a bit more. The good news is that it is possible to combine these methods to create the perfect invoice number template.

For instance, you may find that combining the date and client/project code is the best use. You may wind up with something like this: 2024-05-15-ABC-001. This includes the date, the client code, and a sequential number for that date. It is a great way to garner as much information from nothing more than the invoice number.

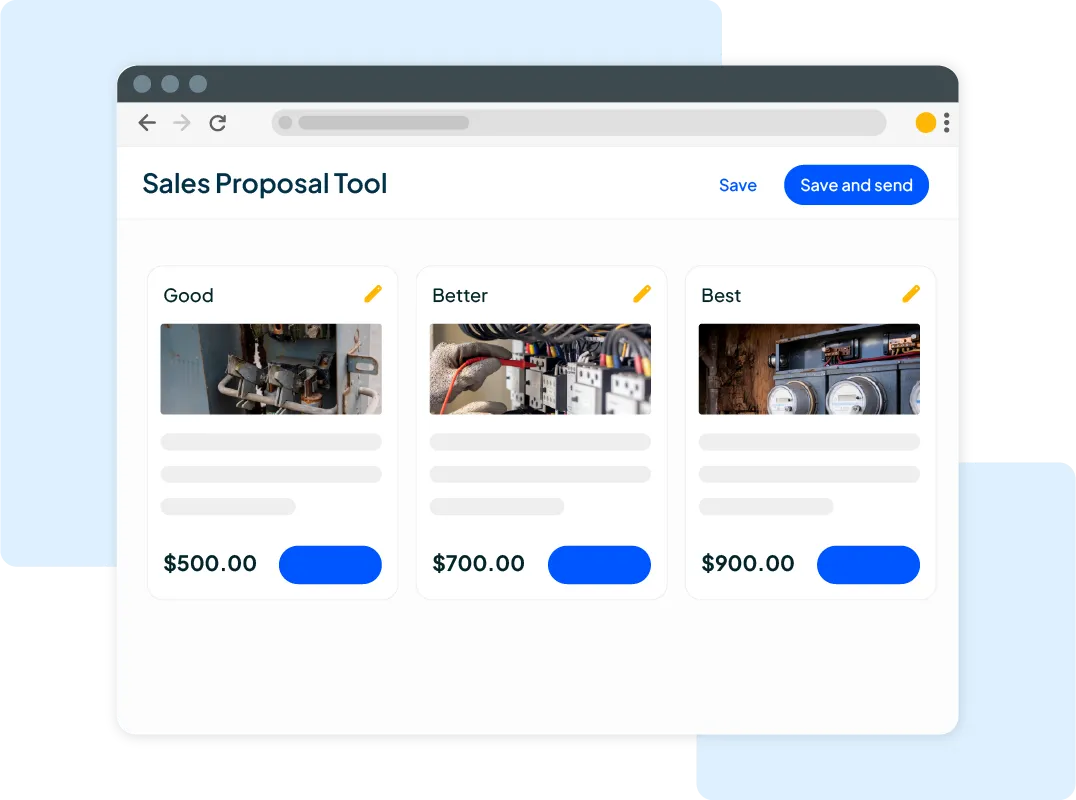

Using Invoicing Software

If you still aren’t quite sure what to do when it comes to creating an invoice number, there is one very simple solution. Invest in invoicing software to do the work for you. There is no need to look for an invoice number example, simply follow the prompts to create a template that is easy for the business to keep track of.

Implementing the right invoicing software or accounting software makes it simple to generate an invoice number. More importantly, invoicing software makes searching for invoice information as simple as possible. Save a ton of time, ensure maximum efficiency, and even choose a preferred format with just a few clicks.

Invoice Number Examples

Now that we are aware of the various methods by which an invoice number can be created, it’s time to get a better idea of what that might look like. Each business’s invoice will have minor tweaks here and there but should include the same general information.

Sequential Numbering

As sequentially numbered invoices are the most common, that is a good place to start. This method starts with a particular number and moves along in sequential order. It is fast, simple, and effective, even if there isn’t much information included within that number. Include the following on a sequentially numbered invoice:

- Business Name

- Business Contact Information

- Customer Information

- Invoice Number (0001, 0002, etc.)

- Invoice Date

- Itemized Services/Goods

- Charges for Each Item

- Total (Taxes Separate)

Including the Date

A favorite of many small businesses is the dated method. It is simple but shows the date of service for that particular invoice. For businesses that only do a few invoices per day, it is a great way to narrow down the information and find the proper invoice without having to do a full search. Here is the information that should be included with a dated invoice number:

- Business Name

- Business Contact Information

- Customer Information

- Invoice Number (Month-Day-Year-0001, Month-Day-Year-0002, etc.)

- Invoice Date

- Itemized Services/Goods

- Charges for Each Item

- Total (Taxes Separate)

Customer or Project Codes

Depending on the business, it is entirely possible to work with a number of customers. Being able to quickly identify that customer’s invoices can be hugely beneficial. For that reason, using customer or project codes can be a preferred method. When creating a customer invoice based on project or customer code, include the following information:

- Business Name

- Business Contact Information

- Customer Information

- Invoice Number (ABC-0001, ABC-0002, etc.)

- Invoice Date

- Itemized Services/Goods

- Charges for Each Item

- Total (Taxes Separate)

Combined Method

For some businesses, a combined method is preferable. Date and/or customer/project codes can be combined into one while also using the sequential method. It is a little more complicated but provides almost all the necessary information to make performing a manual search easier. Here’s what to include:

- Business Name

- Business Contact Information

- Customer Information

- Invoice Number (Month-Day-Year-Client-0001, Month-Day-Year-Client-0002, etc.)

- Invoice Date

- Itemized Services/Goods

- Charges for Each Item

- Total (Taxes Separate)

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

How Can I Fix Invoice Number Mistakes?

Even with a proper invoice number example, mistakes will be made. Mistakes are part of life and the same goes for running a business. The key is to know how to take that incorrect invoice number and rectify the mistake. Sometimes it’s a duplicate invoice number, other times it’s the wrong client. The key is to update documentation so that things ultimately wind up as accurately as they possibly can be.

The good news is that it is quite easy to correct an invoice. If you have sent one out that has the wrong invoice number and the client hasn’t yet paid, simply correct the number and re-send the invoice. Inform the customer of the change and let them know that the most recent document is the correct one.

If you realize that information on an invoice is incorrect but the client has already paid, it is still imperative to send a corrected version. Just be sure that you include, in writing, that the client has already paid. This way, they are informed of the correction but know that they have paid the invoice.

For the most part, these are the two situations your business will be faced with. There are unique situations that arise all the time, but these two situations will be the most common. Knowing how to handle them will keep mistakes to a minimum while maximizing customer satisfaction.

How Long Should I Keep My Business’s Invoices?

Each invoice number is a generated record. It is a good idea for any business to keep solid records so that information is easily accessible when required. On top of that, the Internal Revenue Service (IRS) requires business owners to keep records as well.

The general rule is that business owners need to keep invoice records for at least three years. The same applies to most of the supporting documents that businesses keep, including bank statements, receipts, and payroll records, as well as any other documents that relate to credits, deductions, or income as reported on your tax return.

Why Keeping Invoices is Important

At the end of the day, the burden of proof falls squarely on the business owner. It is critical to back up every item that is reported via tax documentation. It’s always a wise idea for businesses to keep necessary documents like invoices, statements, payroll records, and receipts.

Keeping each invoice number can help create a balanced, manageable budget on both accounts payable and receivable. It also provides a much clearer picture of how much your business has billed. Proper document management can limit stress and mistakes created throughout the documentation process.

How Can I Easily Create Invoices?

With the proper invoice number example in tow, the next challenge becomes creating an easily manageable invoice. When you have the proper template in place, invoices become simple yet effective and your attention can shift to other areas of the business.

One fantastic way to create an effective invoice is by using Housecall Pro’s free invoice template. The right template will allow you to plug in the necessary information and create a reliable template that will serve your business on a daily basis. It is also customizable to fit your business and your business alone.

There is another great way to streamline your invoices and that is through Housecall Pro’s invoicing software. When it comes to generating an invoice number, this professional software will help create smooth, efficient templates. There is even a mobile app that helps control things like invoicing to dispatching and everything in between.

Generate Professional Invoices with Housecall Pro

At the end of the day, you can create the proper invoice number by using Housecall Pro. Our free 14-day trial is available to help streamline the invoice process, create reliable invoice numbers, and help your business become as efficient as possible.

There are many day-to-day challenges of running a business. The very best operations manage to streamline their operations, limit the inefficiencies, and reduce the mistakes to nearly zero. With Housecall Pro’s help, your business can become the best version of itself.