Want to see your potential revenue?

See what businesses like yours earn with Housecall Pro in 1 - 2 minutes.

No business wants to deal with late payments or unpaid invoices. For small businesses, in particular, those issues can have an even bigger impact. The results of these delayed payments could snowball, affecting your ability to pay suppliers and employees or invest in growth opportunities. They also upset your cash flow, rattle client relationships, and cause unnecessary stress on your part.

All that to say—dealing with these issues is never fun. But thankfully, with proactive strategies and proper tools, it’s much easier to stay on top of overdue bills and maintain good financial health. So, how do you collect past-due invoices? Here’s how to collect unpaid invoices (plus a bonus tip about special invoicing software that can simplify the task).

Here’s How to Deal With Late Payments

What’s the Difference Between Outstanding vs. Overdue Invoices?

First things first, we need to differentiate between outstanding and overdue invoices.

An outstanding invoice is one that has been issued but isn’t yet due for payment. For example, let’s say you send out an invoice today for 30 days of payment. This particular invoice would be outstanding until the 30th day. In no-nonsense terms, it’s really just an unpaid invoice.

An overdue invoice, on the other hand, is an invoice that your client still hasn’t paid, even after its due date. Using the same example as above, if your client doesn’t pay the invoice in full by day 31, the invoice becomes overdue.

Knowing this distinction between the two can help you prioritize follow-ups and payment reminders effectively. Your clients with outstanding invoices might only need gentle reminders to let them know they’re approaching the deadline. Those with overdue invoices, though, usually require immediate action and a structured approach to recover payments.

Example: An invoice issued on June 1 with a due date of June 30 remains “outstanding” throughout the month. If the client doesn’t pay by July 1, the invoice becomes “overdue” and now requires follow-ups.

Why Unpaid Invoices Happen

Your clients might not pay their invoices for a handful of reasons. Sometimes, it’s due to a misunderstanding or pure forgetfulness, but in other situations, it’s a financial problem. Knowing the reasons for non-payment of bills can help you adjust your follow-up policy accordingly.

For example, clients with a real financial problem (such as unexpected medical bills) might need more empathetic yet firm communication, whereas for others, a simple reminder might suffice. Here are the most common reasons behind unpaid invoices:

Misunderstandings

Sometimes, the lack of payment stems from a mix-up early on. If the client didn’t understand your payment terms from the get-go, they might have misunderstandings about deadlines or acceptable payment methods. For instance, if the client expects to pay in installments but the contract stipulates a lump sum, delays are likely.

Forgetfulness

Sometimes, life gets in the way, and things that aren’t top priorities slip through the cracks. For some clients, your invoice might be one of those things that fly under the radar, long forgotten in piles of other things to worry about. Busy schedules or a lack of organized reminders might lead to this particular issue, so this is where those timely nudges from you come in.

Even the most well-meaning clients can accidentally miss their due dates. Your gentle reminders can help keep them in the loop and prevent your invoice from ending up on the back burner.

Financial Hiccups

In some cases, financial issues are the culprit behind your client’s lack of payment. Clients experiencing temporary cash flow problems might allocate their limited funds elsewhere, considering your invoice less of a priority.

This could be the result of various issues, such as irregular income, unexpected expenses, or even just poor financial planning. In these situations, you end up with the short end of the stick: no payment.

How Late Payments Impact Your Business

Late or unpaid invoices can drag your business down, affecting all aspects of operations, including paying suppliers and employees. This situation could lead to:

Cash Flow Strain

Payment delays limit a business’s ability to meet day-to-day expenses, such as supply purchases, payroll expenditures, or equipment maintenance costs. On top of that, poor cash flow reduces your likelihood of being able to take on new projects or invest in other business growth opportunities.

Example: A small plumbing business that can’t buy materials for a new project due to tied-up funds in pending payments from previous clients.

Operational Stress

The lack of regular flow due to late payments can add extra pressure to you, as the business owner, too. It’s stressful, especially if you’re not sure how you’ll cover certain bills due to lack of payment, particularly on bigger jobs. Time spent constantly chasing payments is time wasted, given that it could be spent on more important activities like marketing, customer service, or actual jobs.

Financial Risk

Persistent payment delays also pose a risk to your business as a whole. If lack of payment becomes a chronic problem, you could face financial instability that jeopardizes your business. Accruing overdue invoices could result in an inability to meet certain obligations, such as rent or utility bills, and threaten your business’s survival.

How to Prevent Unpaid Invoices & Ensure Healthy Cash Flow

Prevention is the best medicine for unpaid invoices. Here’s how to sidestep late payments and keep your cash flowing regularly:

1. Establish Clear Payment Terms Upfront

Make sure you and your client are on the same page from the get-go. Use plain, simple language when drawing up your payment terms, steering clear of complicated attorney-ish phrases that might puzzle clients.

For example, instead of saying, “remittance should be made within 30 days post-issuance,” say, “Payment is due within 30 days of receiving this invoice.”

State due dates, accepted payment methods, and late fee policies (in simple, no-nonsense terms, of course). Let your clients know what will happen when payments are late, such as penalty percentages or service suspension.

When you have a well-drafted contract in place from the start, you can remove any misunderstandings that might arise from convoluted language and ensure both you and your client are on the same page.

2. Offer Flexible Payment Options

One-size-fits-all rarely works, and the same can be said for payment methods. Not all of your clients will use the same methods, so give them a range of payment options. This could include:

- Credit cards: Convenient, widely used, and make paying easier for customers

- ACH transfers: Preferable for direct bank-to-bank transactions

- Consumer financing: Makes big bills more manageable by breaking them down into tidbits

- Mobile payment solutions: Quick, easy payment methods such as PayPal or Venmo

Variety removes friction and facilitates faster payments. If there is a way that works for their situation and personal preference, your clients are bound to pay on time.

3. Send Friendly Early Reminders

Sometimes, things like bills fall between the cracks, becoming forgotten, even despite your clients’ best intentions. So, to ensure that you get paid, send friendly reminders that periodically nudge your client in the right direction.

Pick the schedule that best suits your needs. You could send out two reminders, one ten days before payments are due and the other 5 days before they’re due. Whichever reminder schedule you choose, remember to include the following:

- Invoice number

- Amount owed

- Payment deadline

- Available payment methods

Early reminders show professionalism and your commitment to ensuring smooth transactions. Plus, they give your clients a little bit of wiggle room to prepare funds and clarify any questions or concerns.

4. Regularly Follow-Up to Keep Outstanding Payments Top of Mind

After the due date, send reminders every 10-14 days. Adjust your tone accordingly based on the client’s payment history—friendly for first-time delays, firmer for repeat offenders.

Here’s a basic overdue invoice template example:

First Reminder: “Hi, Jeff Smith; just a quick reminder that Invoice #24357 for $1,200 was due on December 12. Please let us know if you need any assistance.”

Second Reminder: “Hello, Jeff Smith; our records show Invoice # 24357 for $1,200 is still unpaid. Please arrange payment at your earliest convenience to avoid late fees.”

5. Require Deposits for Large Jobs

One of the best ways to avoid incurring huge losses in case a customer refuses to pay an outstanding balance is by requiring a set amount upfront. For pricier projects, request 25-50% upfront. This secures partial payment and demonstrates the client’s commitment.

For example, if you’re a home remodeling company, you might require a 30% deposit toward material costs before you ever begin a project. This way, you cover your business in the unfortunate event that an unpaid invoice becomes a problem.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by more than 35% after their first year.

See plan options and feature breakdown on our pricing page.

6. Use Multiple Communication Channels

Different clients prefer different forms of communication. So, when communicating reminders, use different forms of communication, such as:

- Overdue invoice reminder emails: This is a great form of formal documentation that’s easy to track and allows you to attach invoices.

- Phone calls: These add a personal touch. Sometimes, speaking with a client directly will help in getting the invoice sorted out far quicker than via written communication.

- Physical mail: Send a letter via certified mail. This way, they have to sign for the letter, which confirms they received it. Sometimes, a formal letter carries more weight than electronic media.

- SMS text: These are most likely to be opened. A clear, direct reminder via SMS might supply an immediate effect.

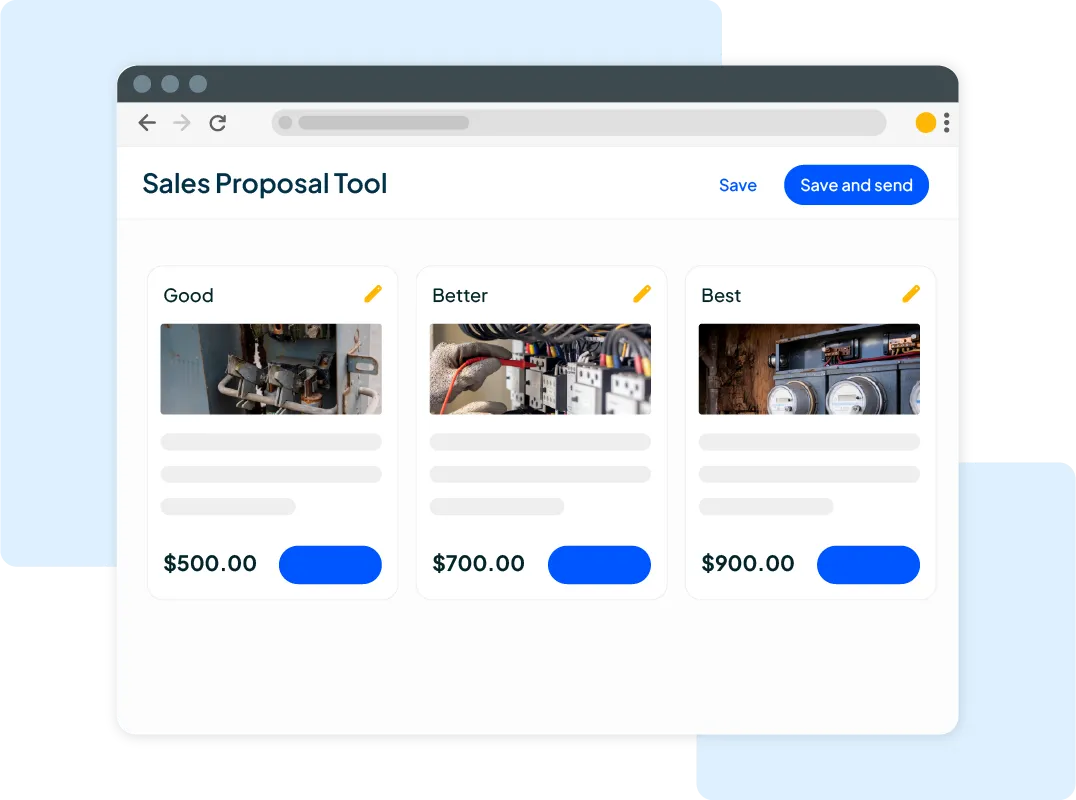

7. Use Automated Invoicing Software

Billing and invoicing can be quite an administrative headache, especially for smaller businesses with smaller teams. That’s where automated invoicing software comes in handy. With this software, you can streamline payments and make it easier for customers to pay.

Housecall Pro’s automated invoicing software, for example, offers features that make invoicing a breeze:

- Instant digital invoices: Send professional invoices via email or SMS to customers with embedded payment links for quick and easy payment.

- Automated payment reminders: Establish timely follow-ups so that your clients will know when payments are due.

- Customizable templates: Personalize invoices to your brand to clearly state payment terms.

- Client portal access: This lets your clients view, download, and pay their invoices via a secure online portal.

- Batch invoicing: Save time by sending several invoices at once to multiple clients.

- Payment flexibility: Accept credit cards, ACH transfers, or mobile payments with ease.

- Recurring billing: Automatically invoice recurring services to reduce tedious work and keep money flowing in.

- QuickBooks integration: Enjoy seamless integration of your financial data and make accounting and tax preparation a breeze.

8. Incentivize Clients With Early Payment Discounts

It might seem counterintuitive, especially since you’re trying to bring cash in, not give discounts that lessen that amount, but early payment discounts can be great incentives. These can not only reduce past-due invoices but also increase client satisfaction, given that customers often like the fact that they can save money while settling their debts.

It doesn’t have to be a crazy high amount. It might be something like 5% of the total bill if the client pays in 15 days. Adjust it based on what you see fit.

How to Collect Past-Due Invoices When Clients Aren’t Responsive

Having a radio-silent client with an unpaid invoice can be incredibly frustrating. When this happens, here’s how to collect unpaid invoices while preserving client relationships:

1. Charge Late Payment Penalties

When developing your contract, remember to include late fees within your payment system. This encourages timely payments while being somewhat lenient.

Example: Charge a 1.5% percent monthly penalty for all unpaid dues from month to month.

2. Pick Up the Phone

Sometimes, a direct conversation with your client is the quickest way to resolve an issue. If your client isn’t responding to texts, emails, or good old-fashioned snail mail, pick up the phone and give them a call. Be firm yet understanding, and document the call for your reference.

Here are a few tips to help that call go smoothly:

- Prepare key information in advance of the call, including the invoice number and amount due.

- Keep the conversation professional and solution-focused.

- Offer options where possible, such as partial payments or a payment plan (if you offer them).

3. Send a Demand Letter

If you’re dealing with a client who still hasn’t paid their invoice, which is now long overdue, it may be time to send a demand letter. This should include:

- The amount your client owes

- The date it was due

- Possible consequences of failing to pay, such as going to court

Keep the letter professional in order to maintain goodwill while conveying urgency. Your demand letter should clearly indicate the seriousness of the situation without burning any bridges.

4. Suspend Services

In cases of continued non-payment, withdraw your services until they pay outstanding invoices. This protects your business interests and reminds clients that they need to settle their accounts. This can be a great tool, especially when the services you offer are related to the ongoing needs of the client.

5. Hire a Debt Collection Agency

As a last resort, look for professional intervention. Be aware of any relevant legalities, such as whether or not you can include interest for late payment on invoices.

A debt collection agency can be an effective partner in this, but it’s important to note that this will most likely burn bridges and leave that particular relationship bitter. Use this sparingly and only as a last resort after you’ve tried everything else.

Your Roadmap to Avoiding Overdue Payments

While it’s not the most enjoyable part of owning a business, managing unpaid invoices and overdue payments is a must. With a general understanding of the basics of how to collect unpaid invoices and proactively prevent the problem altogether, you can minimize the impact of overdue payments.

Remember that clear communication and efficient invoicing practices are crucial to fostering strong client relationships and ensuring your business remains financially stable. With the right approach, you can confidently navigate these roadblocks and focus on what truly matters—growing your business.

Housecall Pro’s invoicing software is here to make dealing with this problem a breeze. Between automated reminders, flexible payment plans, and instant digital invoicing capabilities, this tool is designed to make billing easier than ever. See how it can benefit your business with a free 14-day trial.