There are plenty of myths and misconceptions in the world of business financing. These misunderstandings can discourage home service pros from exploring funding options that could help their businesses grow. Let’s break down some of the most common myths about business financing so you can make informed decisions for your company.

Let’s debunk these business financing myths

Myth 1: “You need perfect credit to get approved”

One common belief is that only businesses or individuals with spotless credit histories can secure financing. While good credit can open more doors, it’s not the only factor that lenders consider. Many financing options take a more holistic view of your business that includes revenue, cash flow, and growth potential.

In fact, some lenders offer programs specifically designed for small businesses that don’t even require a credit check. Do a little homework and find a lender that works with businesses like yours. Whether you’re looking for flexible repayment plans or no credit checks, there are plenty of solutions out there.

Myth 2: “All debt is bad debt”

Debt often gets a bad reputation, but not all debt is created equal. The right kind of debt can help your business grow, especially if it’s used strategically. For example, securing financing to purchase new equipment, hire more staff, or invest in marketing that will allow you to serve more customers.

Think of it as an investment in your company’s future. The key is to make sure the debt you take on fits your business goals and that you’ve planned how to comfortably manage repayments.

Myth 3: “Financing is only for struggling businesses”

It’s easy to assume that seeking financing means a business is in trouble. This couldn’t be further from the truth.

While some may use financing to stay afloat, many successful companies use it as a tool for growth. Whether it’s expanding your service area, buying new vehicles, or upgrading your tools, financing can help you take on bigger jobs, boost profitability, and position your business to grow faster.

Myth 4: “The process is too complicated and time-consuming”

Traditional bank loans can involve a lengthy process with plenty of lobby time. That’s true. But alternative financing options are designed to be much simpler and faster. Today, many lenders offer streamlined applications, flexible requirements, and quick funding, sometimes within a few days.

Modern financing solutions are built with small businesses in mind, and lenders understand the importance of time and convenience. You don’t have hours in the day to stare at a lobby floor. If you’ve been avoiding financing because you think the process will be a hassle, it might be time to revisit your options.

Myth 5: “You’ll lose control of your business”

Some business owners worry that taking on financing means giving up control of their company. This concern often comes from mixing up business loans with equity financing.

Unlike equity financing—where investors take a stake in the company—traditional loans and other forms of debt financing allow you to retain full control of your business. Your lender’s primary concern is being repaid. They leave running your operations to you. This makes loans a great option for business owners who want to maintain independence while securing funds.

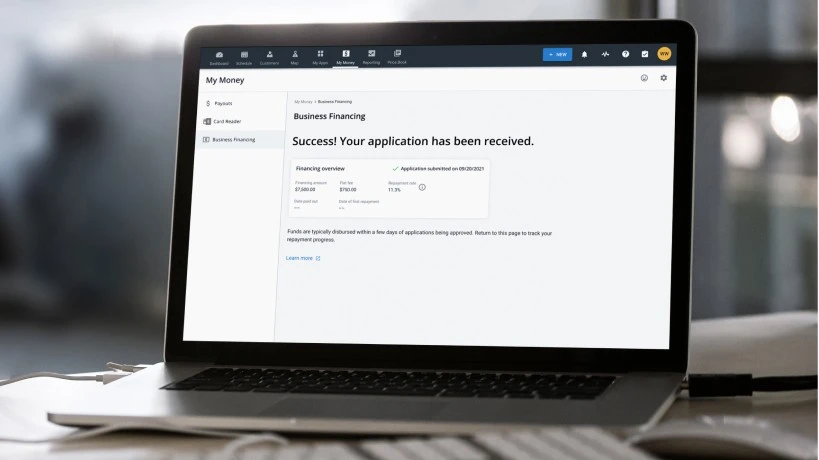

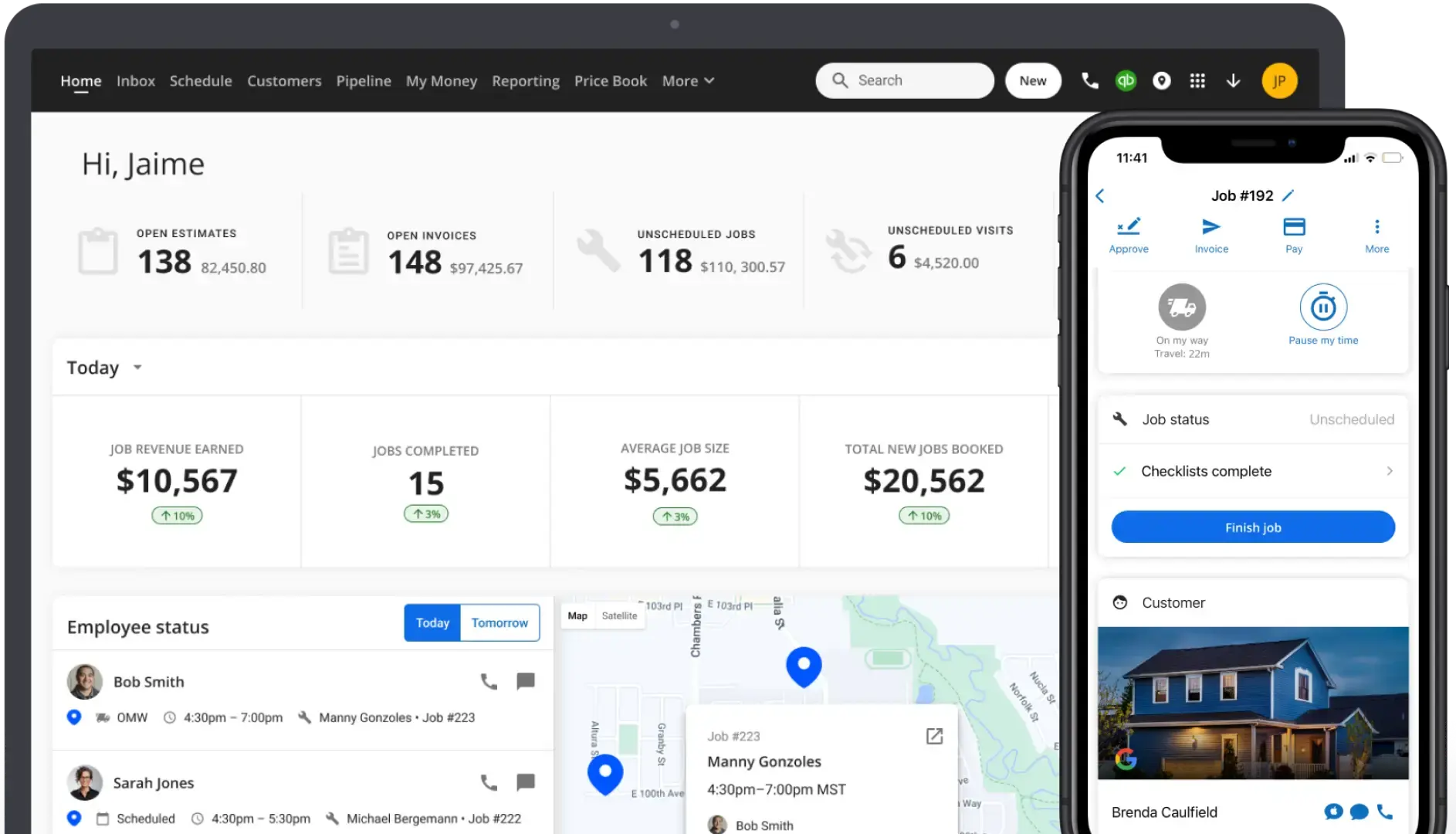

Solutions built for Pros

At Housecall Pro, we understand the unique challenges that home service professionals face. That’s why when it comes to business financing, we partner with trusted providers to help you find solutions custom-tailored to your needs. Whether you’re looking to grow your business, purchase equipment, or manage cash flow, our partnerships make it easier to access the necessary funding. Bust the myths and let’s get you what you need.

Already one of our Pros? Log in to your account now to see if you have an offer available!

Pro tip: To qualify for business financing through Housecall Pro, you have to be an existing user of Payments through HCP Money. Don’t worry, it’s free to sign up!