Over 45,000 companies run on Housecall Pro

Manage your expenses like a Pro and earn 1% cashback

Save time on reconciliations, reimbursements, receipt management, and more with no monthly or annual fees.

Get unlimited 1% cashback on every employee’s purchase

Earn cashback* on business purchases and eliminate the need to distribute your cash or personal credit cards to your team.

-

Equip the whole team with cards and earn cashback on all purchases

-

Track all the spending in your Housecall Pro account

Get more visibility and control in just a few clicks

Stay in control while your employees buy supplies or materials in the field.

-

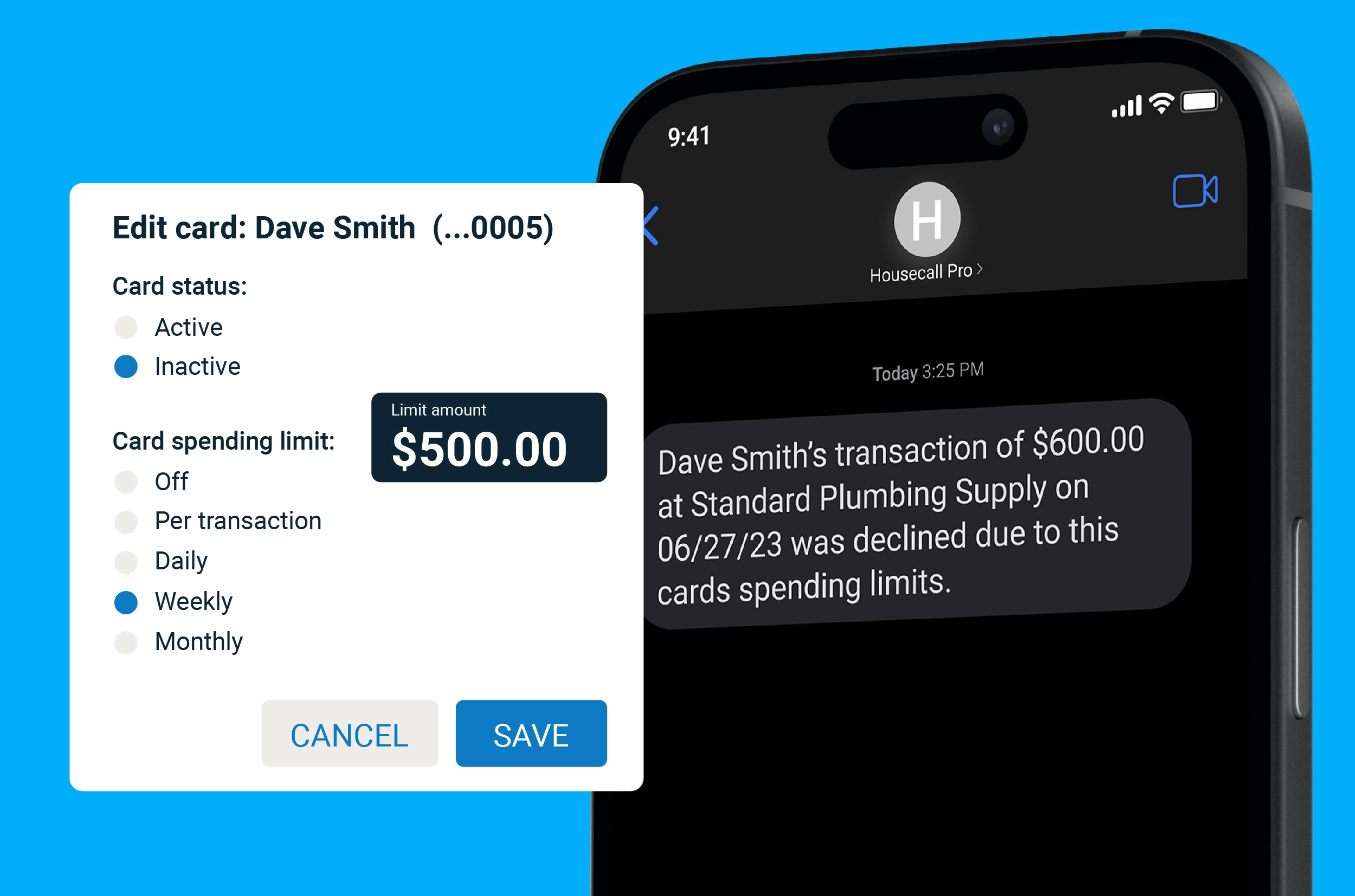

Add spending limits per card for each day, week, or month

-

Set up automatic funding schedules and notifications for transactions

-

Your funds are eligible for FDIC insurance up to $250,000

Let us handle the busy work

We understand how busy you are. Expense Cards eliminate reimbursements, out-of-pocket payments, and manual reconciliations to save your time and help make tax season easier.

-

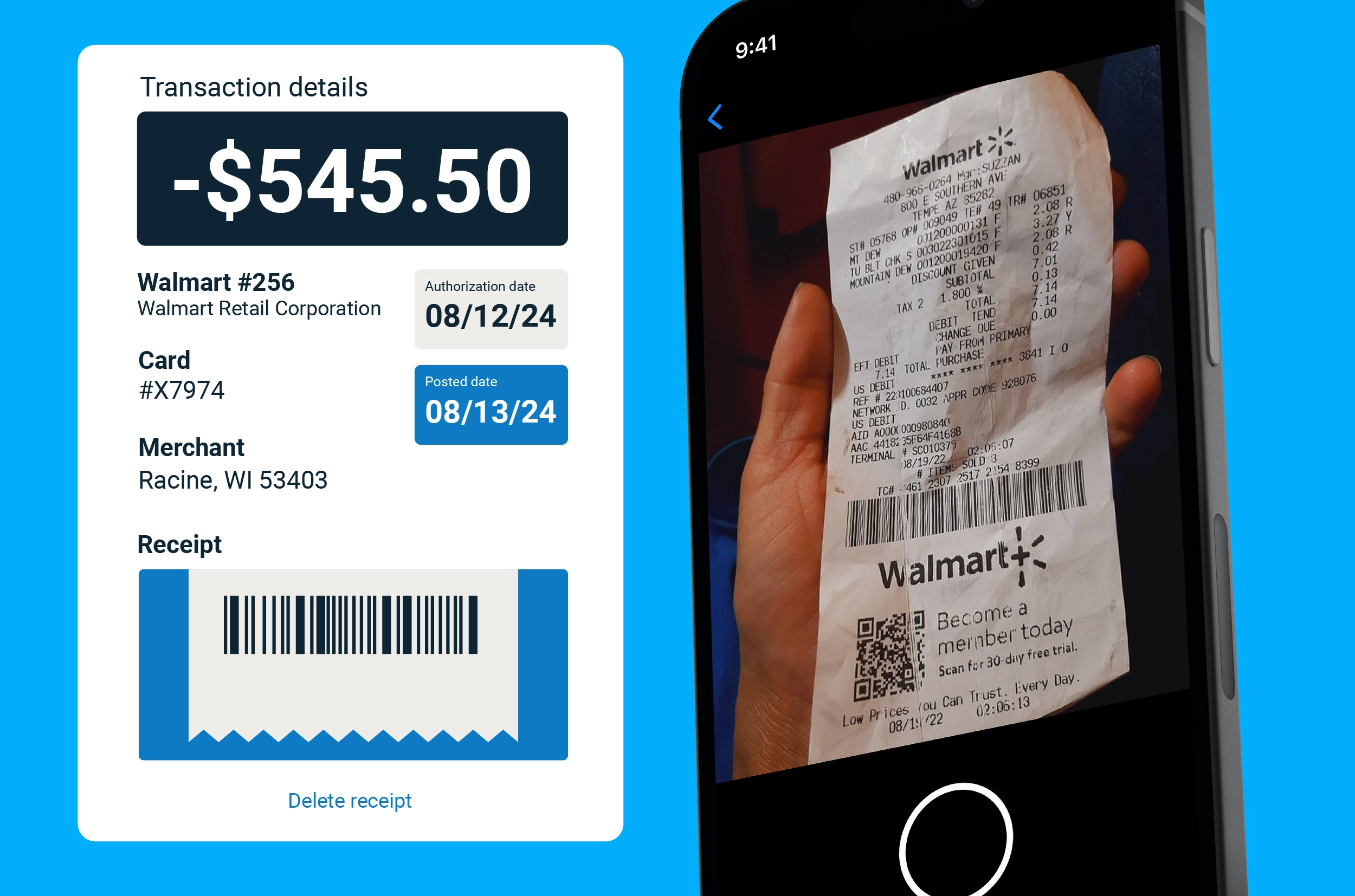

Transactions are automatically categorized and reconciled in QuickBooks Online®

-

Upload receipts directly to each purchase in the mobile app

-

Uncover trends in your company’s spending

What the Pros say

Some Pros are already using Expense Cards— see what they have to say about their experiences with it so far.

“We’ve put three new trucks on the road in the last few months thanks to the Expense Cards. Any person who comes to Housecall Pro from a pen-and-paper…”

Integrity Heating and Air Conditioning

Brewster, NY

“I love Expense Cards! For one, they make it easy to track transportation expenses for financial and tax reporting. Secondly, our employees can purchase fuel wherever they want…”

Bradbury Garage Doors

Vista, CA

Expense Cards FAQ

- How much do expense cards cost?

-

Expense Cards are included in your Housecall Pro subscription at no additional cost. There are no sign-up fees, monthly fees, or overdraft fees.

- What are Expense Cards?

-

Housecall Pro Expense Cards are issued by Visa and can be used for in-store and online business payments. When you sign up for Expense Cards, you’ll also receive a financial account with HCP and can order as many cards as you need for your employees at no charge. Those cards can be used to purchase supplies, materials, or pay for online subscriptions using funds deposited into the account.

- Can Expense Cards be used everywhere?

-

Expense Cards can be used with any merchant that accepts Visa. However, you can restrict how much your employees can spend by managing card settings in your Expense Cards dashboard.

- Will Expense Cards integrate with my accounting software?

-

Expense Cards are automatically integrated with QuickBooks Online.

- Is my financial account eligible for FDIC insurance?

-

Yes – when you register for Expense Cards, you will also receive a Financial Account. The funds you add to your Expense Cards will be deposited and held in the financial account, which is eligible for FDIC insurance.

*Cashback rewards are deposited as a statement credit in your HCP Money account. Click here for additional information on the rewards terms.

Housecall Pro Expense Card is a Visa Commercial Credit Card issued by Celtic Bank. Money transmission services provided by Stripe Payments Company with funds held by Evolve Bank & Trust, Member FDIC.

Get In Touch: 858-842-5746

Let us earn your trust

On average, Pros increase monthly revenue generated through Housecall Pro by 35% after their first year.

See plan options and feature breakdown on our pricing page.