Whether your home-service business is just getting off the ground or if you’ve been operating for years, a proper accounting system is essential to ensuring the fitness of your finances. By using the right tool to monitor your company’s money, you can quickly track your income, see what you’re spending, and find out whether your customers are paying their bills on time. And although the modern software marketplace is overrun with accounting programs, when it comes to small businesses, there is perhaps no bigger name than QuickBooks.

For more than two decades, QuickBooks has been the de facto accounting software for small businesses across a vast number of industries. From restaurants to retailers and plumbers to painters, professionals in nearly every line of business have benefited from QuickBooks. And while for many years QuickBooks was limited to desktop computing environments, there now exists an alternate version of the software that’s accessible from any internet-connected device.

QuickBooks Desktop (QBD) and QuickBooks Online (QBO) offer two distinct approaches to small business accounting, each with its own set of strengths and weaknesses. Yet this division between the traditional QBD software and the cloud-based QBO solution leads many home-service professionals to wonder which version of the software might be a better fit for them. And, indeed, it can be confusing if you’re not familiar with each flavor of the accounting software and what it has to offer.

So how do QuickBooks Desktop and QuickBooks Online compare, and which version is better suited for home-service companies like yours? This comprehensive comparison of the features — and limitations — of QBD versus QBO will help you understand what each of these options can bring to your business.

A Quick Look at QuickBooks Desktop

QuickBooks Desktop (formerly known as simply “QuickBooks”) is a version of the accounting software that is installed on an individual desktop computer and primarily used by one person. Businesses have relied on QuickBooks Desktop for decades, and many professional accountants are intimately familiar with the program. Updated versions are released each year, with new features and functionality added annually.

- Features — Overall, QBD offers a more robust set of features than its online counterpart.

- Pricing — With QBD, businesses pay for the software once, and it’s theirs to use forever.

- Devices — Your account can only be accessed from one computer unless you pay extra.

- Support — Live telephone support is available at a rate of $89 for 90 days.

Pros and Cons of QuickBooks Desktop

Here’s a look at the biggest advantages and potential drawbacks of using QuickBooks Desktop for your home-service business.

Pros:

- Includes an extensive set of features

- Doesn’t require an internet connection

- Supports multiple types of inventory control

- Better for businesses with complex needs

Cons

- 24/7 customer support costs extra

- Can only be accessed from one computer

- Software should be upgraded every 2 years

A Quick Look at QuickBooks Online

Unlike QuickBooks Desktop, which exists on a physical computer, QuickBooks Online lives in the cloud, allowing your account to be accessed from any device with an internet connection.

- Features — QBO offers some functionality unavailable in the traditional desktop version.

- Monthly Pricing — Instead of a big, up-front fee, QBO is based on a subscription model.

- Devices — With your username and password, log into your account from any device.

- Support — All QBO plans come with unlimited around-the-clock support.

Pros and Cons of QuickBooks Online

Here’s a look at the biggest advantages and potential drawbacks of using QuickBooks Online for your home-service business.

Pros

- Offers a few functions not found in QBD

- 24/7 customer support comes with every plan

- Accessible anytime and from anywhere

- Easy to share access with an accountant

Cons

- Lacks several features included with QBD

- Not ideal for all businesses that sell products

Why Use QuickBooks Desktop?

There are a few situations in which QuickBooks Desktop might make more sense for your home-service business than QuickBooks Online would. One scenario would be if your company offers an extensive array of products and services, and your finances aren’t nearly as straightforward as those of a smaller business. In this case, your business could benefit from the rich selection of features included in QBD.

Here are three more instances in which it might make more sense for your business to use the desktop-based version of QuickBooks:

1. You sell physical products. QBD includes an assortment of inventory management tools whereas QuickBooks Online only supports one method.

2. You want to use advanced, industry-specific features. QBD has evolved substantially over time and now includes solutions for specific types of businesses.

Why Use QuickBooks Online?

While QuickBooks Desktop has been many business’s accounting software of choice dating all the way back to the late 1990s, in the modern era, the online version of the tool can be a far better way to go. The inherently mobile nature of QBO can be transformative for home service professionals who detest spending time at a desk, and the ability to share access with others can likewise be beneficial for smaller companies without an in-house accountant.

Here are three additional scenarios reasons why QuickBooks Online might be a better fit for your business.

1. Multiple team members need access. If you share accounting responsibilities with other members of your business, QBO allows individuals to use unique logins.

2. You need real-time numbers. QBO provides up-to-the-minute info about your finances, rather than making you wait for transactions to reconcile at the end of the day.

3. You want to add and edit transactions from anywhere. If you want to be able to create and access your finances from anywhere, QBO gives users that option.

QuickBooks Desktop vs QuickBooks Online Features

To make it even easier for you to determine whether QuickBooks Desktop or QuickBooks Online is a more suitable solution for your home-service business, here’s a breakdown of which features they each offer.

| Feature | QuickBooks Desktop | QuickBooks Online |

|---|---|---|

| Generate Invoices | ✅ | ✅ |

| Track Sales and Expenses | ✅ | ✅ |

| Manage Accounts Payable | ✅ | ✅ |

| Manage Sales | ✅ | ✅ |

| Download Tax Reports | ✅ | ✅ |

| Schedule Automatic Invoices | ✅ | ✅ |

| Accessible from Any Device | Additional fee | ✅ |

| Share Access | $40 per user per month | ✅ |

| Integrates with Other Apps | – | ✅ |

| Software Install Required | ✅ | – |

| Cost | $299-$1155 annually | $17-$760 per month |

| Software Updates | $299 annually | Occur automatically |

| Schedule Automatic Invoices | ✅ | ✅ |

| Unlimited Technical Support | $89 for 3 months | ✅ |

| Inventory Tracking | Multiple Methods | First-in First-out Only |

| 30-day Trial | ✅ | ✅ |

| 60-day Refund | ✅ | ✅ |

| Industry-specific Tools | ✅ | – |

| Syncs with a Bank Account | $10-$15 per month | ✅ |

| Encrypted Backups | $9.99 per month | ✅ |

| Security | Limited by what your computer has | Bank level 256-Bit Encryption |

| Job Costing | ✅ | ✅ |

| Customizable Reports | ✅ | ✅ |

| Industry Specific Reports | ✅ | – |

| Easy To Add Features | – | ✅ |

| Automatic Updates | – | ✅ |

| Graphs of Key Finances | – | ✅ |

| Must Have Internet to Use | – | ✅ |

Which Is Better for Home-Service Businesses?

For many home-service businesses, QuickBooks Online is the obvious choice. This is especially true for smaller companies, which don’t have an in-house accountant tied to a desk but that do have employees who are always on the go. QBO is more affordable and agile than the desktop version of the software, and its inherent mobility and unlimited support make the cloud-based version of QuickBooks even more attractive. You have the ability to function and use it anywhere and have the freedom to integrate with third-party apps like Housecall pro. There is an ecosystem of over 250 apps that can be integrated with QBO, and this number is still growing.

On the other side, if you spend the entire day in the office instead of out in the field, have an in-house bookkeeper, and can be fully serviced by the functionality directly in QuickBooks, then QuickBooks Desktop is the better choice.

Getting Started with QuickBooks Desktop

Despite the many advantages offered by QuickBooks Online, for some business, QuickBooks Desktop might make more sense. If you’re interested in getting started with QBD, head over to their website and pick the plan that’s most appropriate for your business.

Depending on how many users you want to share access among (3 or 5), you’ll either select the Pro or Premier plan. (The Enterprise version is overkill for the majority of home-service businesses.) From there, you’ll be prompted to download and install the software before importing your company’s financial information.

Getting Started with QuickBooks Online

If QuickBooks Online seems like an appropriate solution for your home-service business, it’s easy to get started. Begin by visiting the QuickBooks Online signup page and choosing the plan that meets your needs.

Depending on how many people you want to share access with — as well as whether or not your business sells physical products — you’ll likely end up choosing between the Essentials and the Plus plans. Each of these options includes a free, 30-day trial and unlimited live support. Once you’ve selected the plan that’s right for your business, finish creating your account and uploading your existing financials.

QuickBooks Update

Let’s now take a look at QuickBooks online in 2021, a program for years looked at as being incomplete and not being fully functional is growing by the month with new features. QBO was primarily frowned upon for not offering as much customization, being able to automatically send invoices, have job costing abilities, or provide the same security as Desktop. All of which has changed over the past few months to provide more functionality and make the system better and easier to use.

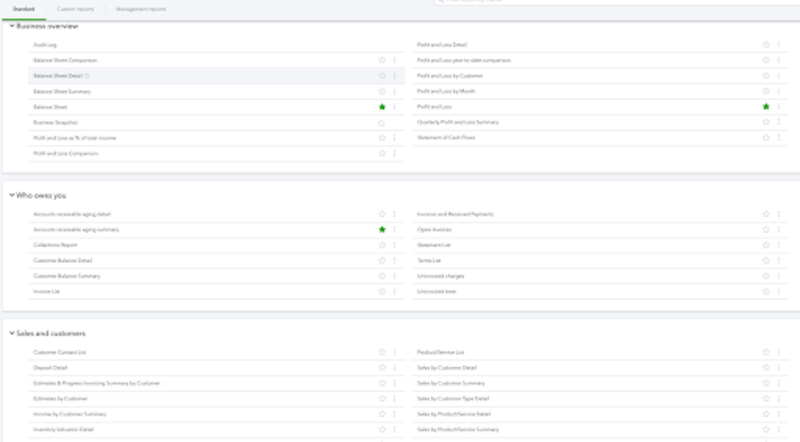

Customized Reports

Back then, you couldn’t pull industry-specific reports and could only access mildly customized reports within the system. Now, customization has increased on the internal reports and more reports are added now, with over 60 reports included in QBO Plus without even looking at job costing reports, payroll reports, or other add on options.

Sending Invoices

As for automatically sending out invoices, all we need to do here is simply create a recurring template to occur automatically, and your invoices will be sent automatically for you after only having to set up the process once. Moreover, you can now send multiple identical invoices at once with QBO Advanced, and I’ll let you in on a secret: this is coming to QBO Plus also.

Job Costing

Five months ago, you could only use QBD if you wanted to do job costing, and we know that In the field service industry, job costing is very common. After the updates though, now we can track labor costs even if we don’t use QBO for our payroll. We can track job supplies, job time, purchases, and anything directly related to income or expense to a particular job. So what about our indirect cost? The hours of our office employees, rent, electricity for the building and anything like that? Well, QuickBooks is now working on an extension to job costing, which will ultimately make job costing in QBO much more robust than it is in Desktop.

Security

Misconception #1: you might think that since QuickBookscloud-based, security is an issue. Your data is hosted on a company’s server, which could be a potential target for hackers.

Wrong. First, QBO is secured by 256-bit encryption, which is bank level, military-grade data encryption, also the most advanced on the consumer market. Second, your data isn’t just stored on one server at one time, it’s stored all over the world on multiple servers and is only parsed together when you confirm the login through email or text message.

Misconception #2: big companies are much more likely to get hacked because they have more information, and the hackers will get a bigger bang for their buck.

Wrong. Small businesses have become the biggest target for hackers, more so than individuals. Why? Because they have more information with records, customer files, payment methods, employee information, and money than individuals. The hackers don’t simply get your information, but they also get your customers and employee information too. Hackers know that small businesses tend to have fewer security features, so it’s easier to get past one antivirus program or a single firewall. QuickBooks also has a security team of people monitoring 24/7, and they can shutdown a server quickly when an intrusion is sensed.

Common QuickBooks Online Complaints

So why do so many people, accountants included, say QuickBooks Online sucks? It is hard to pinpoint as there are many reasons, but we will address a few of the most common ones:

1. Accountants are most commonly against it because QuickBooks Online is a new system, and it functions the same but looks different. The job of an accountant is now to advise you on how to grow your business from those financials and business experience in a specific field. With that being the case, an accounting solution designed for the end user is better so that you can get the most out of your accounting.

2. QBO was designed to be user-friendly to the end user not to the accountant. The screens an accountant is used to seeing are still there but hidden and not as easy to find. This means it’s “harder” to use because QBO is honestly more complicated than QuickBooks Desktop.

3. QuickBooks Online is a new program that you have to take the time to learn.

4. Early adopters saw what QuickBooks Online was like 5 or 10 years ago and were appalled by it and may still be burned by how it works.

Conclusion

In conclusion, is Online the same as Desktop? Absolutely not, it never will because Desktop was designed in the 90s and still looks relatively similar to that. Whether you’re searching for an ideal accounting solution to help your new business get off the ground, or if your an experienced professional thinking about switching away from your current software, one of these QuickBooks solutions can likely deliver exactly what you’re looking for. But based on the nature of your business and its unique needs, one of these programs is likely to be of more benefit to you than the other.

Housecall Pro’s integration with QuickBooks Online and QuickBooks Desktop empowers our Superpros to securely import their customer list, invoice history, and price list data to Housecall Pro — all with a single click. And once a job is completed, each of the line items and charges that appear on an invoice will automatically sync to your QuickBooks Online and QuickBooks Desktop account.

Author Bio: James is the owner of Waterford Business Solutions and along with his team focuses on providing high-quality modern bookkeeping to home service pros. James has worked closely with Housecall Pro as a certified partner helping pros to clean up, setup, transfer data and understand how to use Quickbooks and Housecall Pro. Please visit Waterford for more information or to schedule a free consultation.